Forgetfulness is a common ADHD trait, and it can get us into serious financial trouble. If you forget to pay your bills, you might be hit with late fees, damage your credit score, and make you feel like you’re no good at adulting.

Trust me - I get it. I used to struggle to remember to pay my phone bill and other monthly financial obligations. After missing a credit card payment and learning my little mistake would be on my credit report for seven years, I decided to take action:

I implemented several fail-safe methods to guarantee my bills were paid on time.

How to pay bills on time (with ADHD)

1. Set your future self up for success

This is the mindset I want you to have when figuring out which of these bill-paying strategies to use. If you put in a little work and time now, you can make your future bill-paying quick, easy, or even automated. Future you will thank you for the help.

2. Set recurring calendar reminders

Using your preferred calendar app (Apple iCal, Google, etc.), make a calendar just for bills. (My bills calendar is red, since that color signals urgency to me.)

- Make a list of all your bills and their due dates

- Enter each bill and due date as a calendar event

- Set events to repeat each month so you don't have to input this info again

- I also like to set a few reminders: one week and two days before each due date. But - set your reminders for whatever frequency makes sense to you.

3. Pay your bills with auto-pay

Many credit card and utility companies now offer Auto Pay, which is just what it sounds like: automatic payment of recurring bills.

- Pro: Once you set up automatic payments, you won’t have to worry about paying bills on time again

- Con: You could overdraft your account if you don’t have the money when the auto payments occur

Personally, I don’t use auto pay. As a freelancer, my paychecks vary in size and frequency. But, it's a great option if you're salaried and receive the same approximate paycheck each payday.

4. Set multiple reminders

To make sure I don’t forget important, recurrent tasks like bill-paying, I set reminders in multiple places. As described above, I have monthly reminders in my phone calendar. But I also write reminders in my Bullet Journal and I get monthly reminder emails from my credit cards.

5. Pay all of your bills at once

If you want to alleviate most of your Money Anxiety, take care of all your bills in one sitting. When I can do this, I feel a huge sense of relief once my bills are paid because it means I don’t have to worry about remembering to pay bills for almost a whole month.

You try it: Pick a date and time when you have:

- Enough money in your account

- Time to sit down and pay all the bills

- The space/privacy to focus without interruption

6. Pay the next two weeks’ bills each time you get paid

If you're paid on a consistent schedule, make a habit of paying bills the day you get your paycheck. If you're paid once a month, pay off all of that month’s bills on payday. If you’re paid every 2 weeks, pay the next 2 weeks’ worth of bills on payday. This will help you with budgeting.

Bills are non-negotiable, so they should be paid first before "fun" or optional expenses. Once you’ve paid this pay period’s bills, the remaining money is your budget for the next two weeks (or month, etc.).

7. Track your bills with a spreadsheet

For about a decade, I've tracked my bills on a simple spreadsheet. The first column is bill names (Chase credit card, electric bill, etc.) listed in chronological order of their due date. The second column has due dates, and then I have 12 columns for each month.

When I pay a bill, I mark my spreadsheet with an “X.” I can easily check my sheet any time to get quick visuals of my outstanding bills each month. As an added bonus, it's incredibly satisfying each time I mark a bill as "paid".

8. Outsource the task

If you share bills with a partner, ask if they’d be open to handling certain payments. When dividing up household chores, go by your individual strengths. Many ADHDers struggle with motivation and forgetfulness, which is why we sometimes forget to pay bills or do chores. When it comes to ADHD behaviors like this, I like to see them as neutral facts about ADHD brains.

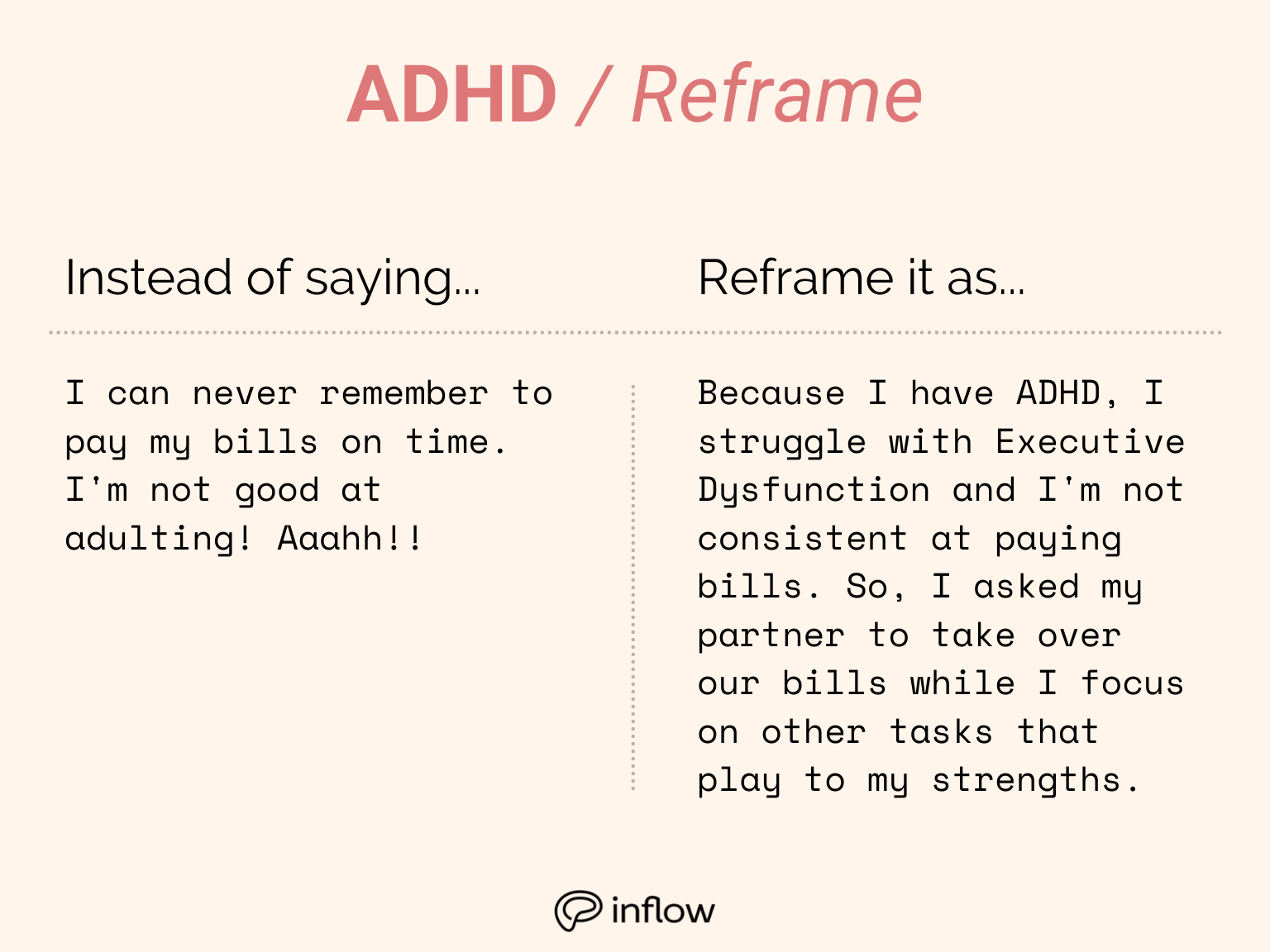

For example, instead of saying, “I can’t remember to pay bills on time. I’m no good at adulting,” re-frame that by telling yourself:

“Because I have ADHD, I struggle with executive dysfunction and I'm not consistent at paying bills. So, I asked my partner to take over bills while I focus on other tasks, like cleaning, walking the dog, or whatever my strengths may be at the time.” If having someone else pay the bills is an option, there is no shame in delegating that task. Of course, make sure your partner is comfortable with this arrangement and that you're also doing your share of household tasks.

Final thoughts

I have ADHD and I'm also very stubborn. I used to pride myself on my refusal to ever ask for help because I insisted I could figure it out on my own. I have since accepted and embraced my ADHD diagnosis, in part by letting go of guilt around my executive dysfunctions.

This is just how my brain works - I have to work a little harder or ask for help to get certain things done. And that's OK. I figured out how to accomplish things I’m not great at: cleaning, paying bills, being on time. It’s taken years of trial and error to get to this place.

Spoiler alert: I've grown immensely. I'm now relatively tidy, I haven’t missed a bill payment in over five years, and I always show up to appointments on time...okay, not always, but usually! Like all humans, I'm a work in progress.

If you have ADHD, you’ve probably spent a lot of time figuring out how to manage your forgetfulness and lack of motivation. You may not even be conscious of all the ways you’ve adapted your neurodiverse traits to survive in a neurotypical world. (i.e. “masking”)

Give yourself credit for making it this far. Our society was not designed for brains like ours, but you’re making it work anyway. Supposedly “easy” tasks ( i.e. bill-paying) can be overwhelming and sometimes feel impossible for people with ADHD.

You are not alone in this struggle — that’s why there are so many tools available to help us remember our adult responsibilities. Tap into the many technological resources available to you, implement your preferred systems, ask for help if you need it, and enjoy the freedom of knowing you’ll never miss another bill.

.jpeg)